It has been a particularly busy time around the Support Department in the first third of 2016. We have had the pleasure of adding several new private medical practices and a couple of billing service customers.

Not a customer yet? Get your free demo today!

In the process of training those new customers to use their Iridium Suite practice management system, I started to think about issues common to everyone: claim rejections.

Someone outside of the “billing circle” would probably assume a rejection and a denial are the same thing. To those of us “in the know” they are two totally different things.

When the payer has processed a claim and has determined no money will be paid for the service(s) rendered, that is a denial.

A rejection has not made it into the claims processing system. It has been stopped either at the clearinghouse level for a data level error/omission or at the payer level based on their pre-processing claim edits.

A rejection has not made it into the claims processing system. It has been stopped either at the clearinghouse level for a data level error/omission or at the payer level based on their pre-processing claim edits.

Our clearinghouse tracks rejections, so I wanted to get an idea of what the top causes are. My hope is to provide guidance in using some of the built-in advanced functions in the billing software to prevent these rejections.

I found the top clearinghouse level rejections to be issues with the Coordination of Benefits. When you receive a rejection message that mentions COB, it is likely to be one of these 3 culprits:

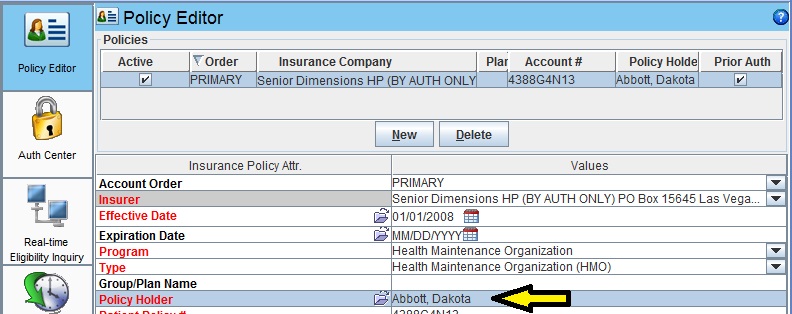

1. When the policy holder of the insurance is different from the patient, that information is sent on the claim. In Iridium Suite, it is indicated in the Insurance Policy Manager, under Policy Holder:

You select the policy holder from the Patient Contacts. If a contact is used for the policy holder, the DOB becomes mandatory just like for patients. When that or any other mandatory data is incomplete, you will have a rejection message that references patient relationship to insured:

2. When submitting a secondary claim, the primary EOB data must balance out to the total on the original claim. When an ERA is auto-adjudicated, all adjustments are recorded in order to produce the SPR that attaches to the secondary claim. When a payment is manually posted, we can take shortcuts or miss some details that will cause the data on the secondary claim to be out of balance.

Example: Code 99215 billed to primary for $150.00. Primary allowed $100.00, applied $2.50 in a Payer Initiated Reduction, paid $77.50, and applied $20 co-insurance. If the $2.50 was missed, the EOB would only add up to $147.50 instead of $150.00 and the secondary claim would be rejected by the clearinghouse.

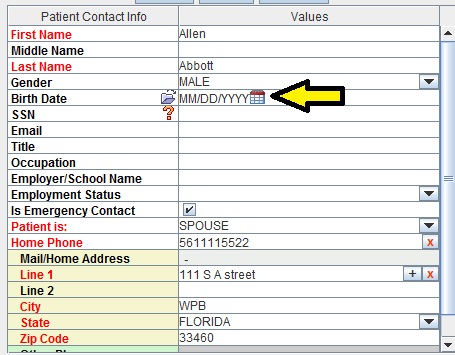

3. There could be insurance priority issues in the General Information/Insurance Policy Manager of the Patient Account: a payer is entered with the wrong priority (primary instead of secondary) or two primaries with overlapping of effective dates. The clearinghouse might be getting what looks like a secondary claim with an EOB, but the claim itself is marked that the payer is primary. To prevent this, turn on this scrubber in your Practice Manager and you will be warned if you accidentally have two insurances of same priority at the same time:

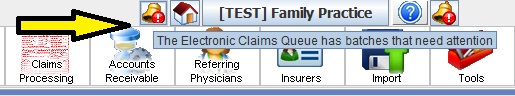

All rejections appear in your Electronic Claims Queue. Rejections should be looked at daily and will be indicated by an alert icon on the title bar:

Don’t leave your money on the table. The Proof of Timely filing report cannot help in appealing timely filing denials on rejected claims. These have not been received by the payer so don’t delay in making the proper fix and re-invoicing these claims.

Don’t leave your money on the table. The Proof of Timely filing report cannot help in appealing timely filing denials on rejected claims. These have not been received by the payer so don’t delay in making the proper fix and re-invoicing these claims.

Check back next month for Part 2: Payer Level Rejections